What do You Mean by Insurance?

Insurance

Insurance is a contract between an individual and entity the ensured and an insurance company the insurer in which the insured pays a premium in exchange for the insurer's promise to cover financial losses resulting form the certain events or risks. The insurer agrees to to compensate the insured for any losses and damages suffered as a result of a cover events in accordance with the term of policy.

Types of Insurance

What are the 5 main Insurance?

There are many different types of insurance policies available, but here are five main types of insurance:

Health insurance: This type of insurance helps to cover medical expenses, including doctor visits, hospital stays, prescription medications, and more. It can be purchased by individuals or provided by employers.

Auto insurance: This type of insurance provides financial protection in case of an accident involving a vehicle. It can cover damages to the car, injuries to the driver and passengers, and liability for damage to other people's property or injuries to other people.

Homeowners insurance: This type of insurance covers damages and losses to a home and its contents caused by events like fires, theft, or natural disasters. It can also provide liability coverage for accidents that occur on the property.

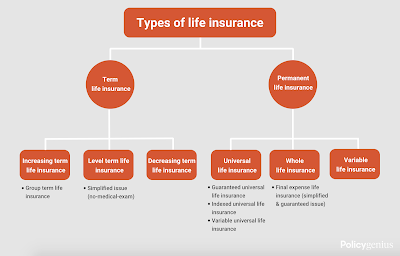

Life insurance: This type of insurance provides financial support to beneficiaries in the event of the policyholder's death. It can help cover expenses such as funeral costs, outstanding debts, and loss of income.

Disability insurance: This type of insurance provides income replacement if the policyholder becomes disabled and is unable to work. It can help cover living expenses and medical bills while the policyholder is unable to work.

There are several principles that guide the insurance industry. Here are some of the main principles of insurance:

Utmost good faith: This principle requires both the insurer and the insured to act in good faith and provide complete and accurate information when entering into an insurance contract.

Insurable interest: The insured must have a legitimate interest in the property or person being insured. This principle ensures that people do not take out insurance policies on things or people that they have no legitimate interest in.

Indemnity: This principle states that the insured should be restored to the same financial position they were in before the loss occurred. Insurance policies are not intended to be a source of profit for the insured.

Contribution: This principle applies when there is more than one insurance policy covering the same risk. Each policy pays out a proportionate amount based on the level of coverage.

Subrogation: This principle allows the insurer to take legal action against a third party responsible for the loss to recover the amount paid out to the insured.

Proximate cause: This principle determines which causes of loss are covered by the policy. The cause of the loss must be a direct result of a covered event in order for the policy to pay out.

These principles help ensure fairness, transparency, and accountability in the insurance industry.

Insurance Importance

Insurance is important for several reasons, including:

Financial protection: Insurance provides financial protection against unexpected events, such as accidents, illness, or natural disasters. Without insurance, individuals or businesses may struggle to cover the costs associated with such events.

Risk management: Insurance helps individuals and businesses manage and mitigate risk. By transferring the risk to an insurer, they can protect themselves from potential financial loss and reduce their exposure to risk.

Peace of mind: Insurance provides peace of mind knowing that if something unexpected happens, there is financial protection in place. This can help reduce stress and anxiety, allowing individuals and businesses to focus on other important aspects of their lives.

Legal requirements: Some types of insurance, such as auto insurance, are legally required in many states. Failing to have adequate insurance coverage can result in fines, legal fees, and other penalties.

Business protection: Insurance is important for businesses, as it can help protect against liabilities, property damage, and loss of income. This can help businesses stay afloat during difficult times and continue to serve their customers.

Overall, insurance is an important tool for managing risk and protecting against financial loss. It provides peace of mind and helps individuals and businesses navigate unexpected events.

What is Insurance in Short Form?

Insurance is a contract between an individual or entity (the insured) and an insurance company (the insurer) in which the insured pays a premium in exchange for the insurer's promise to cover financial losses resulting from certain events or risks.

What is the full form of CV Insurance?

There is no widely recognized or standard full form of "CV Insurance" in the insurance industry. It is possible that "CV" in this context refers to a specific insurance product or policy offered by a particular insurance company, which may have its own unique meaning or full form. It is recommended to check with the specific insurance company or context in question to determine the intended meaning of "CV Insurance".